free cash flow yield calculator

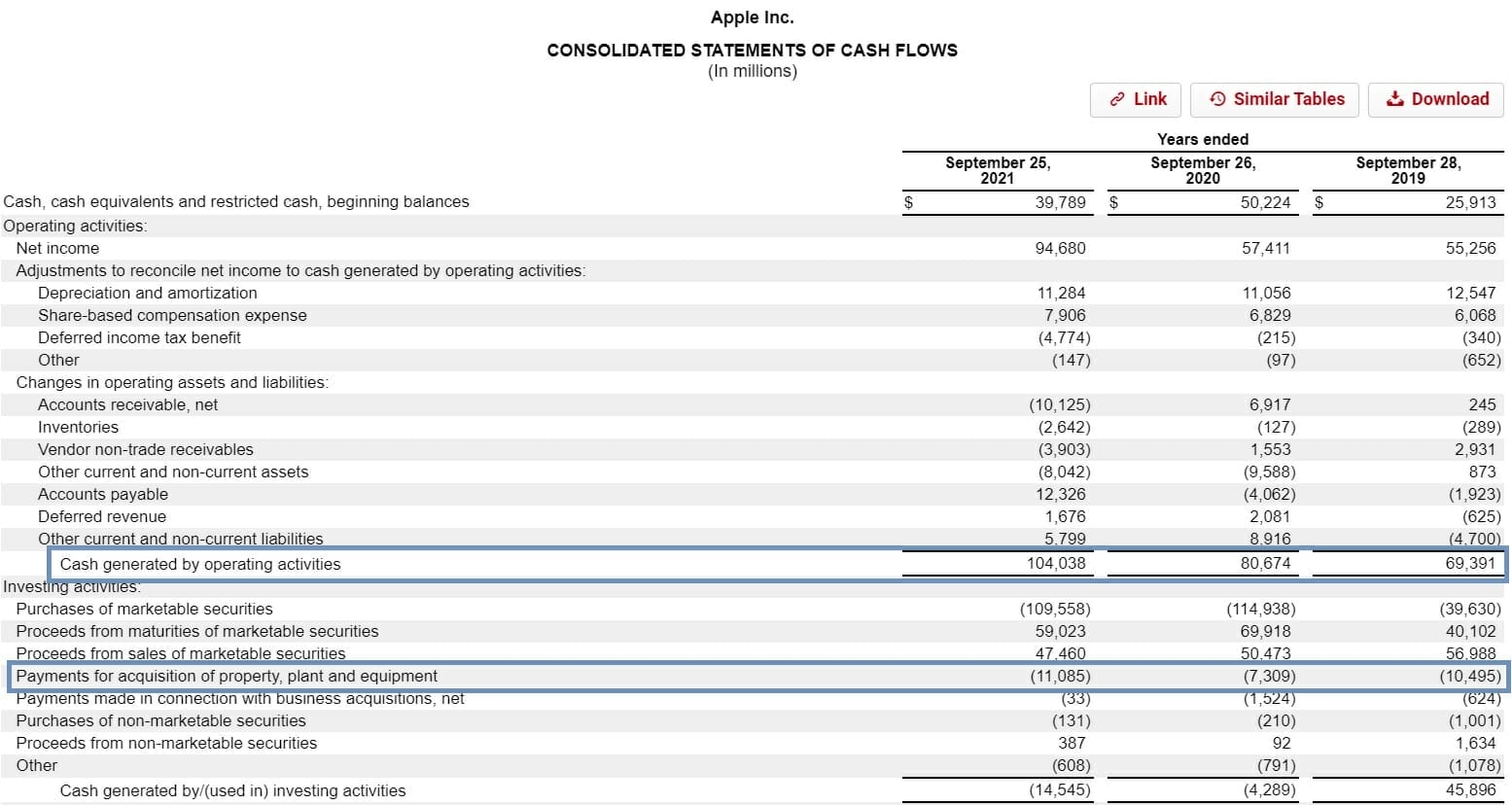

And free cash flow yield free cash. FCF can be calculated by starting with cash flows from operating activities on the statement of cash flows because this number will have already adjusted earnings for non-cash.

Learn To Calculate Yield To Maturity In Ms Excel

FCF Net Income Depreciation Amortization Stock based compensation Impairment Charges Gains or losses on Investments AR 2018 AR 2017 Inventory 2018.

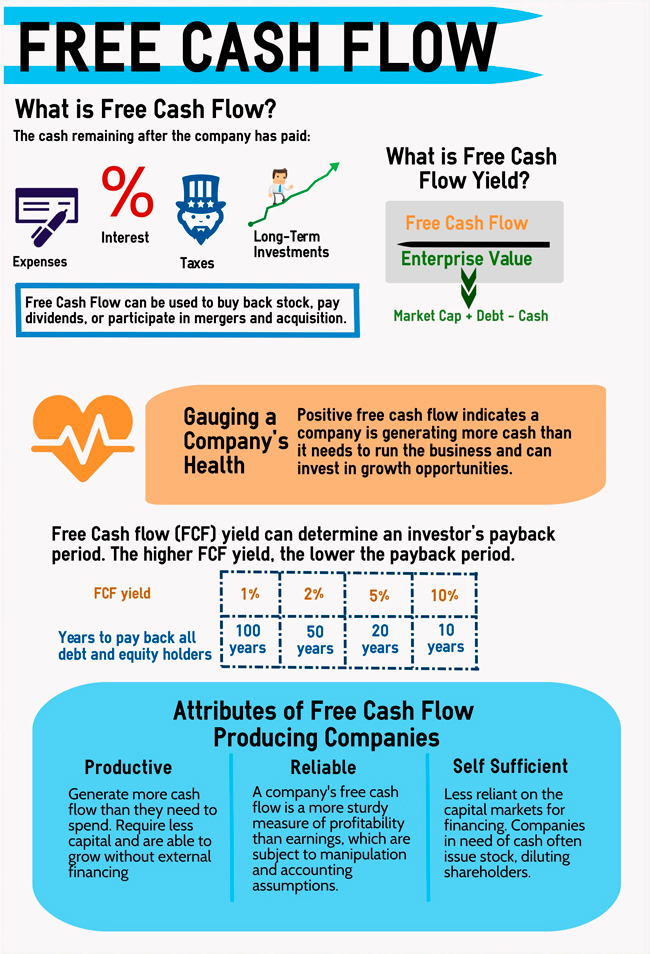

. The computation of free cash flow yield is straightforward. Going forward there is no way to be sure that free cash flow yield will continue to provide the best returns. Free Cash Flow 550 million 100.

The simplest way to calculate free. First calculate free cash flow operating cash flow - capital expenditures. Free cash flow yield is really just the companys free cash flow divided by its market value.

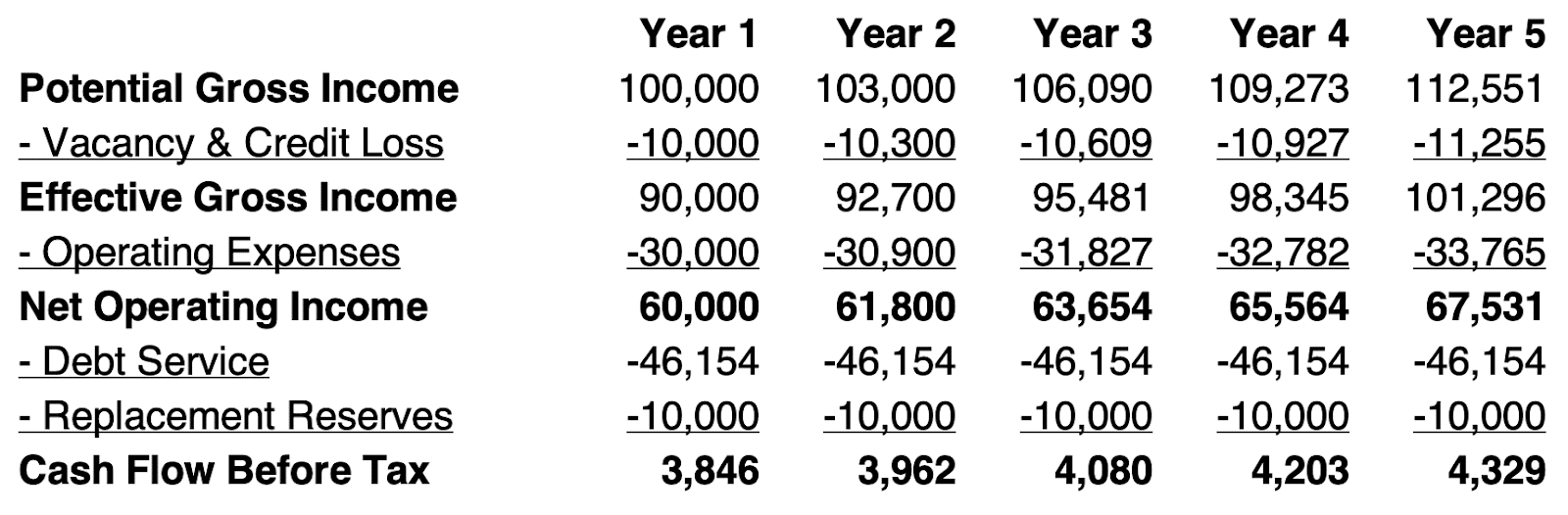

How to Calculate Cash Yield. How to Find and Screen for Great Dividend Stocks. Importance of the Cash Flow Statement for Dividend Investors.

After free cash flow per share free cash flow number of outsanding shares. How to Tell if the Stock Market is Overvalued. Free cash flow yield free cash flowenterprise value offered the investor the highest return and the fewest periods of negative returns.

Free Cash Flow Operating Cash Flow Capital Expenditure Net Working Capital. Cash flow per share - one of the various measures of cash flow including operating cash flow free cash flow variants. 7 Indications to Sell a Dividend Stock.

Free cash flow measures how much cash a company has at its disposal after covering the costs associated with remaining in business. As depreciation is a non-cash expense hence in the estimation of free cash flow we can add this expense back to PAT. To calculate the free cash flow yield of a stock you need to know how much it would cost you to buy the entire company right now market.

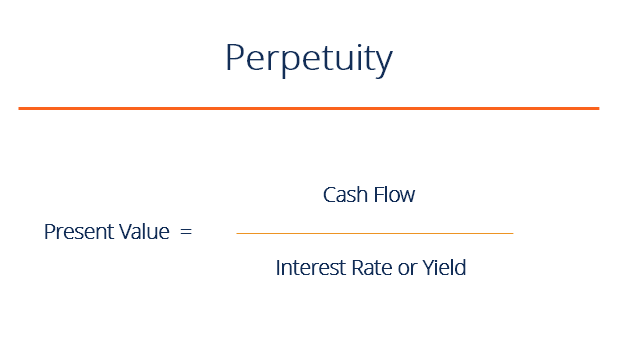

Free cash flow available to the firm for the calendar year is. Cash flow yieldfraccash flow per shareprice per share Where. The free cash flow yield is simply the free cash flow divided by the companys market value.

Net Operating Profit After Taxes Operating Income 1 - Tax Rate and where. In fact there have been market cycles where companies with high free cash flow yields have underperformed. How to Value a Company Using the.

Free Cash Flow Net Operating Profit After Taxes Net Investment in Operating Capital where. It then represents the actual cash available in the hands of the company. The calculation of free cash flow yield is fairly simple.

To break it down free cash flow. In practical terms it would not make sense to calculate FCF all in one formula. 10 Dividend Investing Tips to Always Remember.

Free Cash Flow Yield. FCF Net Income Non-Cash Expenses Incrase in Working Capital Capital Expenditures.

Bond Valuation Calculations For Cfa And Frm Exams Analystprep

All Cap Index Sectors Free Cash Flow Yield Near Record Highs Through 5 16 22

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Perpetuity Definition Formula Examples And Guide To Perpetuities

Dividend Yield Calculator Calculate The Dividend Yield Of Any Stock

Cash Flow Ratio Analysis Double Entry Bookkeeping

The Power Of Free Cash Flow Yield Pacer Etfs

Net Operating Income Noi A Beginner S Guide Propertymetrics

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Singtel Stock Analysis 2018 The Babylonians

Free Cash Flow Yield Formula Top Example Calculation

Free Cash Flow Uses One Of The Most Important Metrics In Finance

Free Cash Flow Yield Formula And Calculation

Free Cash Flow Yield Formula And Calculation

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

Fcfe Guide To Free Cash Flow To Equity Angel One

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)